Found Money Is Better Than Printed Money

Easy alternatives to the standard 30-year mortgage save 5-10% of the house price over seven years. The 50-year mortgage is a distraction from the actual problem: the broken quote process.

I recently walked a family member through how to optimize a mortgage. It took 45 minutes. I drafted this afterward because I realized how many variables there were and wanted something polished for future friends and family.

Running just four basic scenarios across a single lender, I found two alternatives to the standard 30-year, 20% down mortgage. Both save 5-10% of the house price over seven years (a 10% and 20% drop in the total cost of the mortgage, respectively). Any loan officer could do this, but it’s more work and makes their fees transparent, so they prefer rack rate.

If 5-10% savings are sitting there today, the 50-year mortgage is the wrong conversation. It’s a distraction from the actual problem: the broken quote process.

The 50-Year: Worst of All Worlds

Instead of fixing how consumers access the best available rates, we’re discussing the 50-year mortgage—more artificially cheap credit that inflates prices without helping buyers.

The 50-year combines all the downsides of renting (no equity accumulation) with all the downsides of owning (taxes, capex, illiquidity, downpayment, immobility). Artificially cheap credit inflates asset prices, the market adjusts to increased availability, and the buyer ends up with the same house at a longer duration and a higher rate.

The Broken Quote Process

There is a single scenario that is globally optimal for your constraints—desired monthly payment, cash available to close, income, FICO. The odds you’re close to it today: 0%. The cost: 5-10% of your house value, minimum. Likely much more.

Finding it requires running millions of scenarios: increment each variable to look for breakpoints, iterate across all loan products, durations, special programs, LTV thresholds, across 20+ lenders. The levers exist. The issue is deployment.

Today’s tools let a human pull 2-3 scenarios manually. Most loan officers don’t understand the math fully (it’s multi-factorial, non-linear, complicated) and how all the variables interact. Even if they did, they can’t justify the effort.

Loan officers act rationally: expected close rate × commission while minimizing effort. Running these scenarios breaks that equation. The effort goes up non-linearly and doesn’t increase close rate. If anything, it confuses buyers or turns them off, especially when commission comes up.

AI Is the Solution

AI pulls out your constraints through conversation—not by requiring you to understand mortgage terminology upfront. It collects and verifies documents, computes millions of scenarios, and offers the single best option with alternatives to pressure test your preferences. The permutations are massive for humans, but trivial for AI.

The Levers

This isn’t just a think piece. For your next mortgage, use this section as a roadmap. These are the specific variables you should be optimizing. There are a lot of them—that’s the point.

Buyer-Paid Compensation

Brokers take 2-3% of the loan as compensation, baked into the interest rate. Switching to “buyer-paid compensation”—their explicit fee paid in cash by you—drops the rate significantly. In this analysis, going from “lender-paid” to “buyer-paid” saved 1.125% in rate (see Rates tab of rate available with price ~102 vs price ~100).

Once the commission is visible, you can negotiate it down from 2-3% to maybe half of that. I used 2% to be conservative in my estimate, but 1.5% is a good target.

Duration

Rates drop with shorter durations, often giving close to a “free lunch”. The 20-year is the sweet spot: principal portion of the payments increases significantly while monthly payment stays manageable.

Buy-Downs

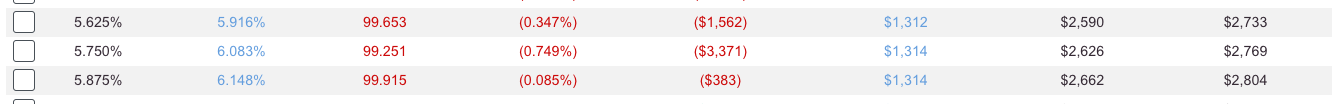

Small upfront costs for permanent rate reduction. In Scenario B, a 0.197% buy-down costing $887 saved 0.125% in the interest rate. Often more. Buy-downs are tax-deductible. Sometimes legacy systems have pricing discontinuities—better rates available with reduced buy-downs. You need a computer to hunt for them.

Here’s an example of a discontinuity where the 5.625% rate actually costs you less (column 5) out of pocket as a buy-down than the 5.750% rate.

A loan officer moving fast is not going to see or find these most of the time.

GSE Loan Limits

Conforming loans under the GSE limit get ~0.500% better pricing. For most areas that’s about $800k loan up to about $1.5m in highest cost areas. If your price point is right around this threshold, optimizing your loan size to be just at or under can have huge savings.

Decline Escrow

Escrow ties up ~1.0% of house price at closing. It’s hard to read: estimates, deltas to estimates when new estimates are made, actual payments in arrears when actual taxes are known, balancing two years at once. I couldn’t get someone at Chase to explain it clearly, so I closed it and took my money back. They wired me 1.0% of the price of my house, overnight.

Escrow can be for tax payments, mortgage insurance payments, and property and casualty insurance. Decline them all. If a lender will not allow you to decline, choose another lender.

Eliminate Bogus Fees

Underwriting fees are negotiable and made up. These are cost offsets itemized and dressed up. The actual specific underlying costs are very low on an itemized basis. The lender here is just grasping for margin because they have such a huge cost base to produce your loan due to their own inefficiency, so they create all these ticky-tack things that add up.

Same for all the other fees (see the Closing Disclosure tab in the model) but generally they’re harder to negotiate and smaller dollar (that’s their strategy!).

Title Insurance

Decline title insurance where possible. It’s massively expected value negative for you. Everyone knows it’s a scam — no one even tries to justify it. Just so you know, it’s insurance not for any future events with your title, it’s “errors and omissions” insurance protecting the lender and title agent against any errors they themselves might have committed while performing the title check you just paid them for. It’s retrospective insurance for them, not prospective insurance for you (which is how most insurance works and is what most consumers likely assume)!

Mortgage Insurance

MI is required up to 80% LTV but only auto-cancels at 78%. The 2% buffer is “consumer protection” whatever that means. Set a reminder to cancel manually at 80% LTV. MI is usually a good tradeoff if you want to keep the extra 10% down since your rate doesn’t change materially (or often at all) from 80% to 90% LTV. Put that money to work paying cash commissions, points buy-downs, or simply putting it into anything returning higher than your mortgage rate.

Home Insurance

Pricing is flat across coverage levels. Max out coverage. I discovered this by toggling for 15 minutes—my premium never changed no matter what I selected. The defaults were all medium coverage, so I maxed them out at no extra cost.

Real Estate Agent Fees

Off topic technically for a mortgage deep drive, but the national average is 2.5% for each side, buyer and seller. Never pay the full 3.0%. You can almost always get 2.0% per side without any material change in agent behavior. Below 2.0%, they probably deprioritize you even though that’s illegal.

Never let agents tell you the buyers are not paying the fees. Remember, as the buyer, every single person in the transaction is ultimately paid by you. You are the only source of funds. The system is just cleverly designed to i) minimize how much you feel the pain of paying and ii) for everything to be indirectly financed into the house price which of course is paid by you.

Scenario Comparison Approach & The Math

When comparing scenarios, the only numbers that matters are cumulative expenses paid (assuming the scenario fits your constraints, of course). This is permanent cash out. Equity returns when you sell. It took me a while to grok this. Increasing principal paid is only important to the extent that it reduces tonnage of interest paid over time. Principal timing washes out if you assume an exit date and sale.

Rule of Thumb: Minimize your downpayment while maximizing your principal share of the monthly payment, subject to your constraints—desired monthly payment, cash available to close, income, FICO.

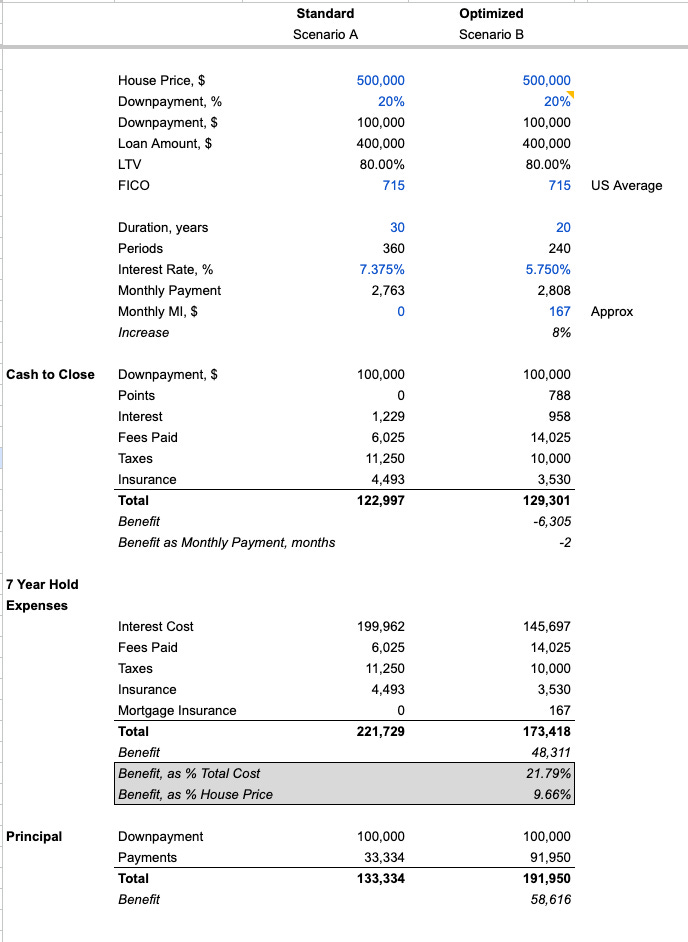

Scenario A: $500k house, 30-year, 20% down, 7.375% rate.

Scenario B: $500k house, 20-year, 20% down, 5.750% rate.

Huge rate savings moving to a 20-year.

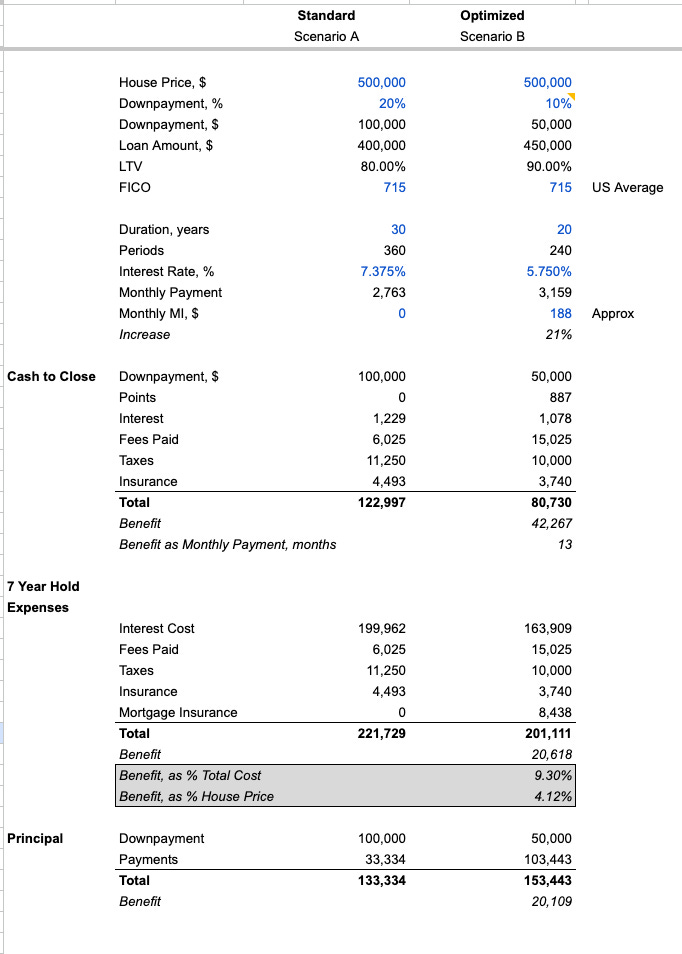

Scenario B: $500k house, 20-year, 10% down, 5.750% rate.

No change in the rate by reducing to 10% down!

More cash down (20%): Keep monthly payment roughly flat. Pay $6,304 more upfront. Save $48,311 in permanent expenses over seven years (9.7% of house price). Build $58,616 more equity that returns when you sell.

Less cash down (10%): Free up $42,267 upfront. Monthly payment 21% higher. Save $20,618 in permanent expenses over seven years (4.1% of house price). Build $20,109 more equity that returns when you sell.

Both scenarios reduce permanent cash outflow by 5-10% of house price over seven years. The choice depends on cash constraints. Remember this FOUND MONEY. I’d take 5-10% of my house back in cash any day of the week. It doesn’t sound as large when normalized to the house price, so calculate the actual dollars. Or you can think of it equivalently as a 10% and 20% reduction in the total cost of the mortgage itself.

How to Use This

Use this as your guide. Walk through each topic with your loan officer. Ask them to run scenarios across these variables. Ask for the “buyer-paid compensation rate.” Force them to optimize across multiple lenders and durations. Check GSE loan limits. Evaluate buy-down ROI. Decline escrow and bogus fees.

Any loan officer who isn’t willing to do this work isn’t working for you. Move on.

You can save 5-10% of your house price over seven years using tools that exist today. The 50-year isn’t the solution. Found money beats printed money.

Love this!